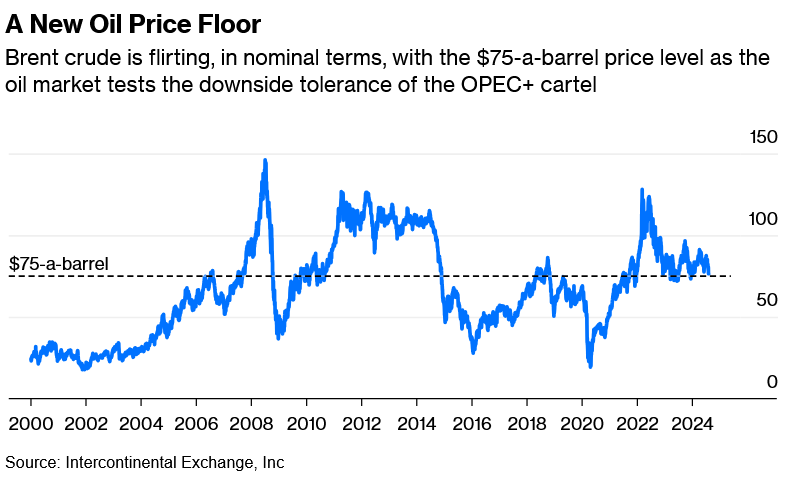

After shifting its focus from $100-a-barrel oil in June, OPEC+ now faces the challenge of defending a floor around $75.

While Saudi Arabia, Russia and their peers can protect this threshold for a few weeks or months, sustaining it beyond late 2024 into next year may prove difficult.

The OPEC+ countries might need to adjust their strategies, potentially allowing crude prices to decrease further in 2025.

Brent crude is currently testing the $75-a-barrel price level. At mid-year, OPEC+ members agreed to a deal that would gradually increase oil supply every month from October.

This agreement included a clause allowing for pauses or reversals based on market conditions, but traders viewed this as an indication of lower prices.

Consequently, OPEC+ output is expected to rise by 500,000 barrels a day by December and about 1.8 million barrels by mid-2025.

Despite the agreement, market realities have not aligned with OPEC+'s expectations. Brent crude recently fell to $75.05 a barrel, its lowest level since early January, significantly below the pre-OPEC+ meeting price.

Saudi Arabia and the other OPEC+ countries now face the challenge of maintaining this price floor.

Global oil demand continues to increase, but supply remains a significant issue for OPEC+. Non-OPEC production, led by the Americas, is increasing rapidly.

This additional output is sufficient to meet the growth in global oil consumption.

Additionally, OPEC+ members such as Russia, Iraq, Kazakhstan, UAE, Iran, and Venezuela are producing more than their limits allow.

As the Northern Hemisphere summer ends, oil demand is expected to experience a seasonal downturn, coinciding with OPEC+'s plan to add more barrels to the market from October.

This could tip the market into oversupply, potentially challenging the $75-a-barrel level. Delaying production hikes could defend this price but might be seen as a strategic adjustment.

The first half of 2025 presents further challenges for OPEC+.

Even with healthy oil demand growth, the group may struggle to increase production and might need to consider additional adjustments.

Maintaining the $75 price level may hold temporarily but not for long.