The Central Bank of the Republic of Türkiye (CBRT) reported a significant decline in sectoral inflation expectations in November, following unchanged interest rates for the eighth consecutive month.

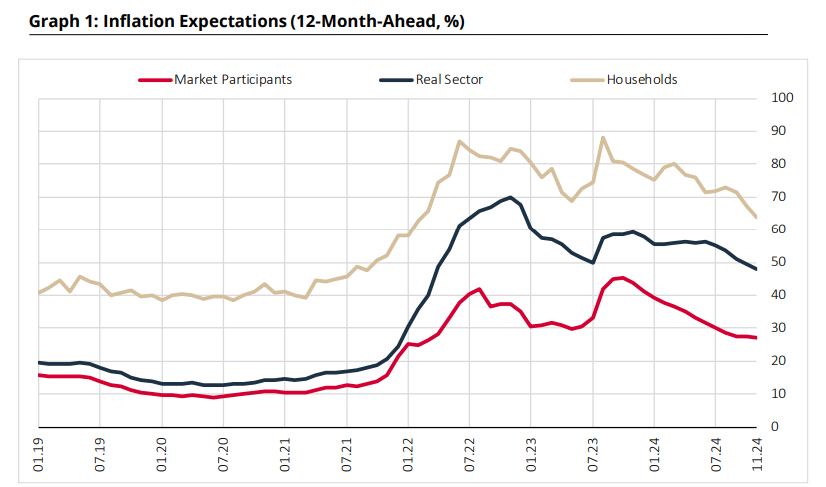

According to a CBRT release on Tuesday, 12-month-ahead annual inflation expectations showed a marked decrease across all surveyed groups. Inflation expectations dropped notably in three groups:

• By 0.2 points to 27.2% among market participants.

• By 1.7 points to 47.8% within the real sector.

• By 3.1 points to 64.1% for households.

The CBRT's decision to hold the policy interest rate steady for the eighth consecutive month reflected confidence in the central bank's strategy to manage inflation pressures without tightening monetary policy further.

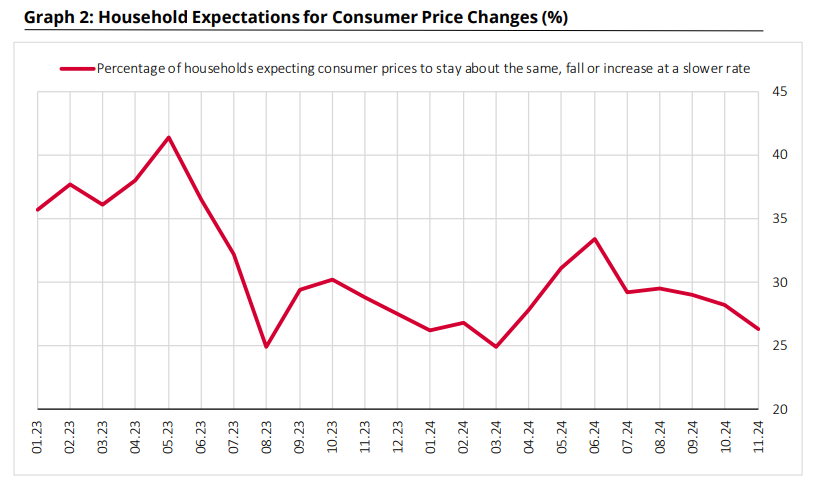

Nevertheless, the proportion of households expecting a decrease in consumer prices over the next year also declined by 2 points to 26.3%, indicating a mixed sentiment among consumers despite the overall downward trend in expectations.

Sectoral inflation expectations are obtained by compiling the 12-month-ahead annual consumer inflation expectations of financial and real sector experts, manufacturing industry firms, and households through the survey of market participants, business tendency survey and consumer tendency survey (CTS), which is carried out in cooperation with Turkish Statistical Institute (TurkStat).

Treasury and Finance Minister Mehmet Simsek evaluated the report in a post on social media platform X, highlighting the improvement in inflation expectations compared to May 2024.

He stated, "This improvement in expectations supports the reduction of inflation rigidities."

The statement is notable, as it may signal an easing of monetary tightness, including a potential interest rate cut in December. The central bank appears to be considering this as well, having delivered a dovish message on the matter.

Dezenflasyon süreci tüm kesimlerde enflasyon beklentilerini olumlu etkiliyor.

Enflasyonda zirveyi gördüğümüz mayıs ayına göre 12 ay sonrası beklenti hanehalkında 12 puan, reel sektörde 8,2 puan ve piyasa katılımcılarında 6 puan iyileşti.

Beklentilerdeki bu iyileşme… pic.twitter.com/tsvcBXrOXE

— Mehmet Simsek (@memetsimsek) November 26, 2024