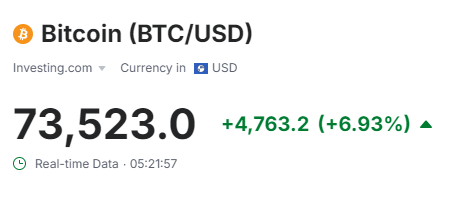

Currency markets showed heightened activity as Republican candidate Donald Trump declared victory. Although the dollar index rose, the Turkish lira opened the day with slight gains against the dollar, euro and pound, while Bitcoin reached a record high.

The Turkish lira appreciates to 34.23 against the dollar. Before the election results became clear, the Turkish lira was at 34.36 at 6.00 a.m. (UTC+3).

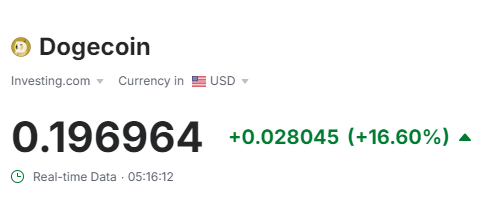

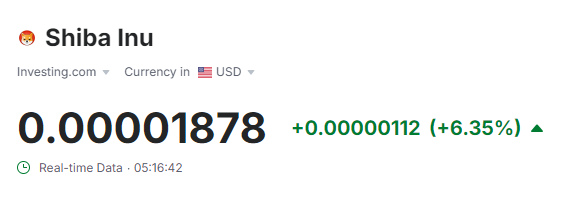

Cryptocurrencies also surged, especially so-called “meme coins” like Dogecoin and Shiba Inu, promoted by Trump supporter Elon Musk, soared alongside Bitcoin.

Bitcoin/USD Exchange Rate, Nov 6 2024. (via investing.com)

Bitcoin/USD Exchange Rate, Nov 6 2024. (via investing.com)

Dogecoin/USD Exchange Rate, Nov 6 2024. (via investing.com)

Dogecoin/USD Exchange Rate, Nov 6 2024. (via investing.com)

Shiba-Inu/USD Exchange Rate, Nov 6 2024. (via investing.com)

Shiba-Inu/USD Exchange Rate, Nov 6 2024. (via investing.com)

TL gains broadly, euro drops sharply, yuan slides

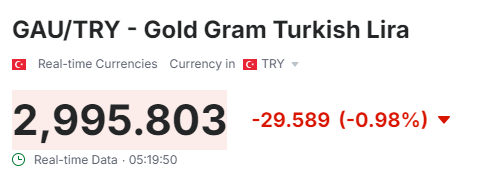

The Turkish lira recorded notable gains, especially against gold and the euro, buoyed by a rising dollar index. The lira’s gain approached 1% against gold and exceeded 1.4% against the euro.

Gold Gram/TL Exchange Rate, Nov 6 2024. (via investing.com)

Gold Gram/TL Exchange Rate, Nov 6 2024. (via investing.com)

Euro/TL Exchange Rate, Nov 6 2024. (via investing.com)

Euro/TL Exchange Rate, Nov 6 2024. (via investing.com)

Meanwhile, the euro fell 1.5% against the dollar, marking its most significant decline since March 19, 2020, amid the COVID-19 pandemic. China’s yuan also depreciated by 0.9%, reflecting broader currency market pressures.

Euro/USD Exchange Rate, Nov 6 2024. (via investing.com)

Euro/USD Exchange Rate, Nov 6 2024. (via investing.com)

CNY/USD Exchange Rate, Nov 6 2024. (via investing.com)

CNY/USD Exchange Rate, Nov 6 2024. (via investing.com)

Trump’s economic policies, market reactions

Market reactions reflect investor concerns over potential shifts in economic policies under Trump, particularly regarding tariffs and taxes. Trump has previously advocated for trade policies aimed at boosting American industries through tariffs, as highlighted in his victory speech, which could create inflationary pressures.

Higher tariffs on imports may strengthen the dollar while putting pressure on currencies sensitive to trade, like the euro and yuan.

Additionally, expected tax cuts could boost market confidence domestically, making U.S. investments more attractive to foreign investors and further supporting the dollar’s rally.

Cryptocurrencies, viewed by some as a hedge against inflation, may have drawn attention from investors speculating on the inflationary effects of Trump’s policies.

The significant rise in Bitcoin and related cryptocurrencies may reflect a flight to decentralized assets amid anticipated market volatility.