The Central Bank of the Republic of Türkiye (CBRT) conducted its largest repo auction since July 2023, lending ₺100 billion (approximately $2.55 billion) to the market through a fixed-rate repo with a maturity date of June 17, 2025. The move has sparked renewed speculation that the central bank may soon begin easing interest rates, following a surprise drop in inflation and a notable rally in banking stocks.

The amount offered at the Tuesday auction was the highest in nearly two years, prompting market analysts to interpret it as a potential pivot back toward using the official policy rate, currently set at 46%, as the main funding instrument. The auction received strong demand, with total bids reaching nearly ₺649 billion. The central bank met about 20% of the estimated ₺500 billion liquidity shortfall, according to local economists, at a significantly discounted rate for domestic banks.

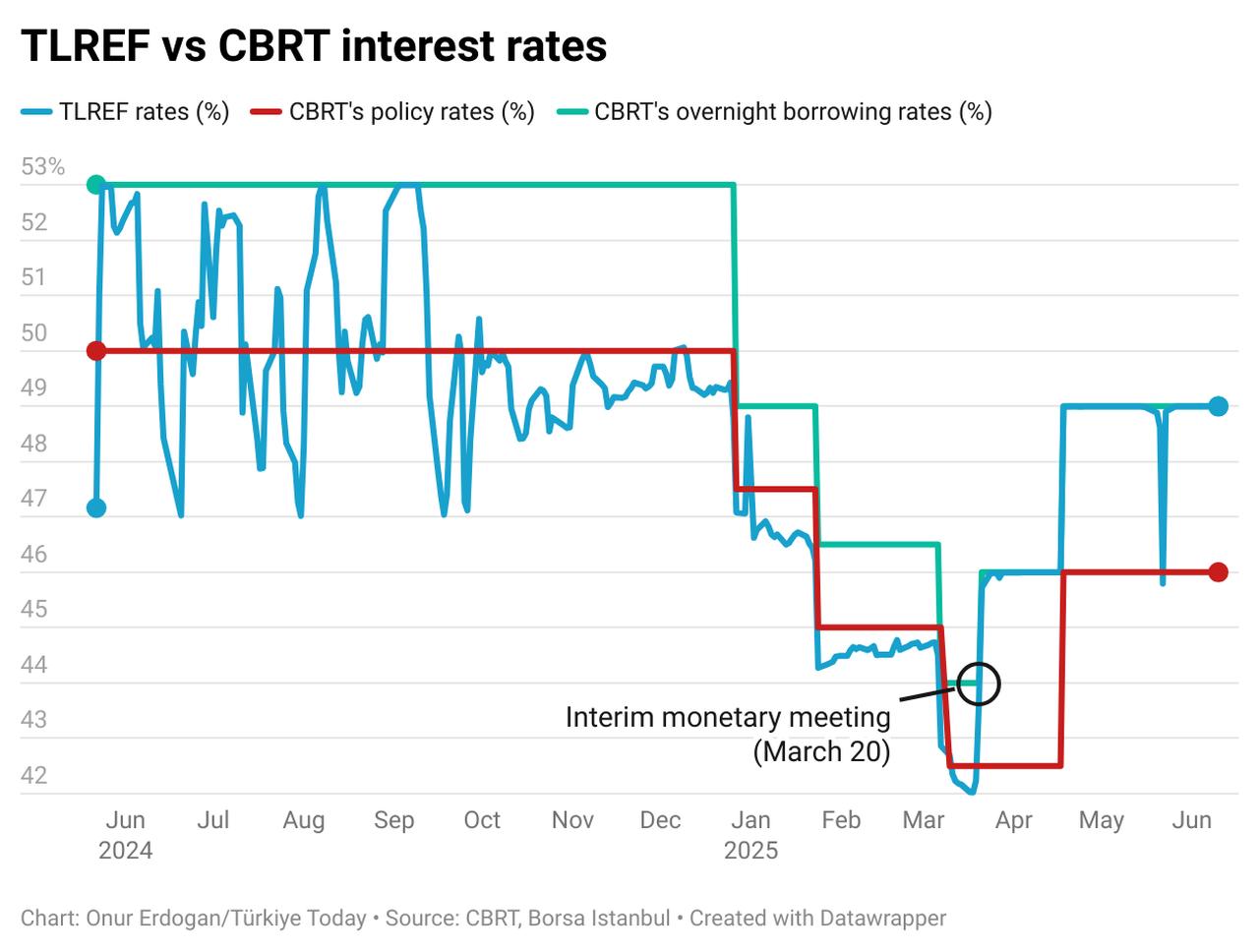

Until recently, banks in Türkiye have been borrowing funds primarily at the overnight lending rate of 49%, which has effectively served as the market’s de facto benchmark—alongside the Turkish Lira Overnight Reference Rate (TLREF), a short-term interest rate that reflects the average cost of unsecured overnight borrowing transactions, which has also hovered around 49%. The CBRT’s decision to provide a substantial amount of liquidity at the 46% policy rate has triggered market expectations that average funding costs may now begin to converge toward the policy rate.

The average and highest interest rates at the auction were both recorded at 46%, with a compounded yield of 58.09%. Analysts noted that the use of weekly repos at this scale suggests the central bank may be preparing to reduce funding costs more systematically, particularly if such auctions become more frequent.

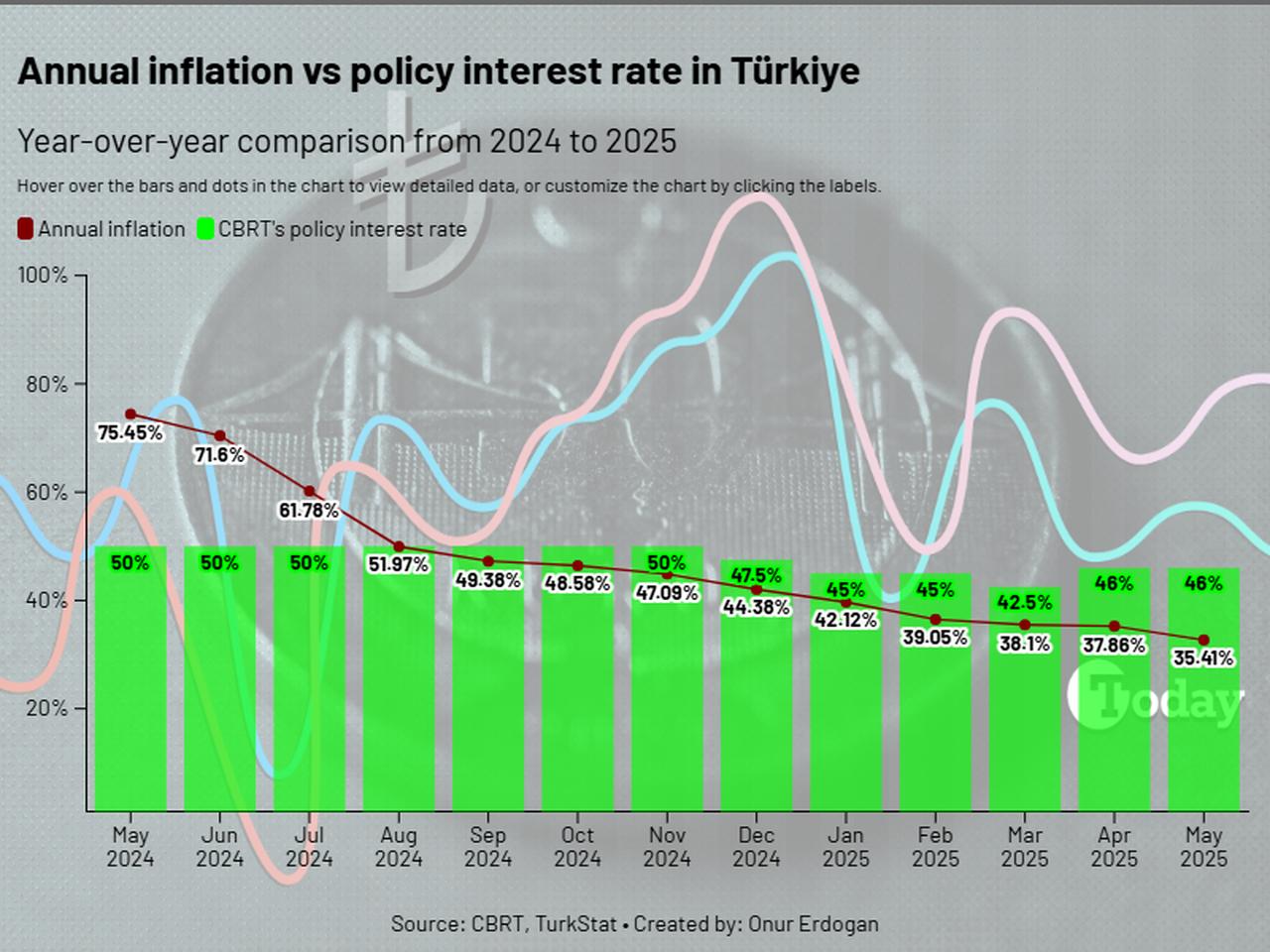

The easing signals have been amplified by better-than-expected inflation data released last week. As May inflation came in below economists’ forecasts at 35.41%, Turkish banking stocks jumped more than 5%, marking their strongest daily performance in three months. Adding to that optimism, the central bank’s recent move triggered a similar rally on Tuesday, with banking shares rising over 5% and the benchmark BIST 100 Index gaining more than 2%. As a result, the banking index has gained 13% since May 30.

Analysts view the CBRT’s latest move as a response to both the improving inflation outlook and persistent liquidity strains in the financial system. They argue that this marks a shift in funding strategy that could set the stage for eventual rate cuts.

Eren Can Umut, research director at Trive Investment, described the auction as a step toward using the weekly funding rate of 46% more actively, suggesting this could lead to a decline in the average cost of funding (AOFM). Although he does not expect a rate cut in June, he believes the central bank’s recent steps make a July cut more likely.

Similarly, Tunc Safa Altunsaray, investment advisor at Info Investment, emphasized that moving to weekly repo funding at the policy rate is an early indicator of a possible rate reduction.

Iris Cibre, a board member at Pusula Portfolio, stated that while she does not expect a rate cut in June, she sees the shift as a form of indirect easing. She added that if the central bank continues holding repo auctions of this scale on a daily basis, it would be a strong sign of a downward trend in interest rates. However, if this proves to be a one-off measure, it could be seen instead as a temporary response to tight liquidity following the holiday period.

The CBRT’s next monetary policy meeting is scheduled for June 19. While the market broadly expects the central bank to hold rates steady, economists from Goldman Sachs and Morgan Stanley have forecast that a rate-cutting cycle could begin as early as July, depending on inflation trends and liquidity conditions.