Former President Donald Trump, now a Republican presidential candidate, is expected to announce bitcoin as a "strategic reserve" during a cryptocurrency conference in Nashville this month.

Trump has promised to be the “crypto president,” with his campaign accepting cryptocurrency payments – a first for a major U.S. political party.

Trump will declare bitcoin a "strategic reserve asset" for the United States, according to Dennis Porter, co-founder and CEO of the Satoshi Action Fund. Porter claims to have "credible" sources confirming Trump's intention

Poter stated that incorporating bitcoin into the U.S. Treasury as a "strategic reserve" appears evident, adding that the world will follow when the U.S. leads.

"Adding bitcoin as a ‘strategic reserve’ to the U.S. Treasury is a no-brainer and once the USA does it, the paradigm will shift and the world will understand they must also have a bitcoin position."

Following the announcement that Trump is hosting a campaign fundraiser in Nashville, the top ticket is priced at $844,600 per person.

A next level down includes a photo with the former president at $60,000 per person or $100,000 per couple, according to the invitation.

A strategic reserve refers to resources held back by governments, organizations, or businesses to manage unexpected events or strategic purposes. Analysts believe this move by the U.S. could signify a significant change in economic policy, leveraging bitcoin's decentralized nature and widespread acceptance to support economic stability.

Market analysts suggest that declaring bitcoin a strategic reserve asset could:

Trump has previously expressed support for bitcoin, warning that anti-bitcoin policies could benefit rival countries like China and Russia. His forthcoming declaration aligns with his campaign's approach, appealing to cryptocurrency advocates and signaling a shift from his earlier criticisms in 2019, when he highlighted the price instability and illicit use of digital currencies.

The U.S., having seized large quantities of bitcoin from illegal entities, is estimated to possess over 200,000 bitcoins. If Trump becomes the first president to officially endorse bitcoin, the U.S. could leverage its reserves for strategic purposes.

However, critics caution that while this news is promising, the impact on bitcoin's price is unpredictable. Aggressive buying without further investment from the U.S. government could lead to price volatility.

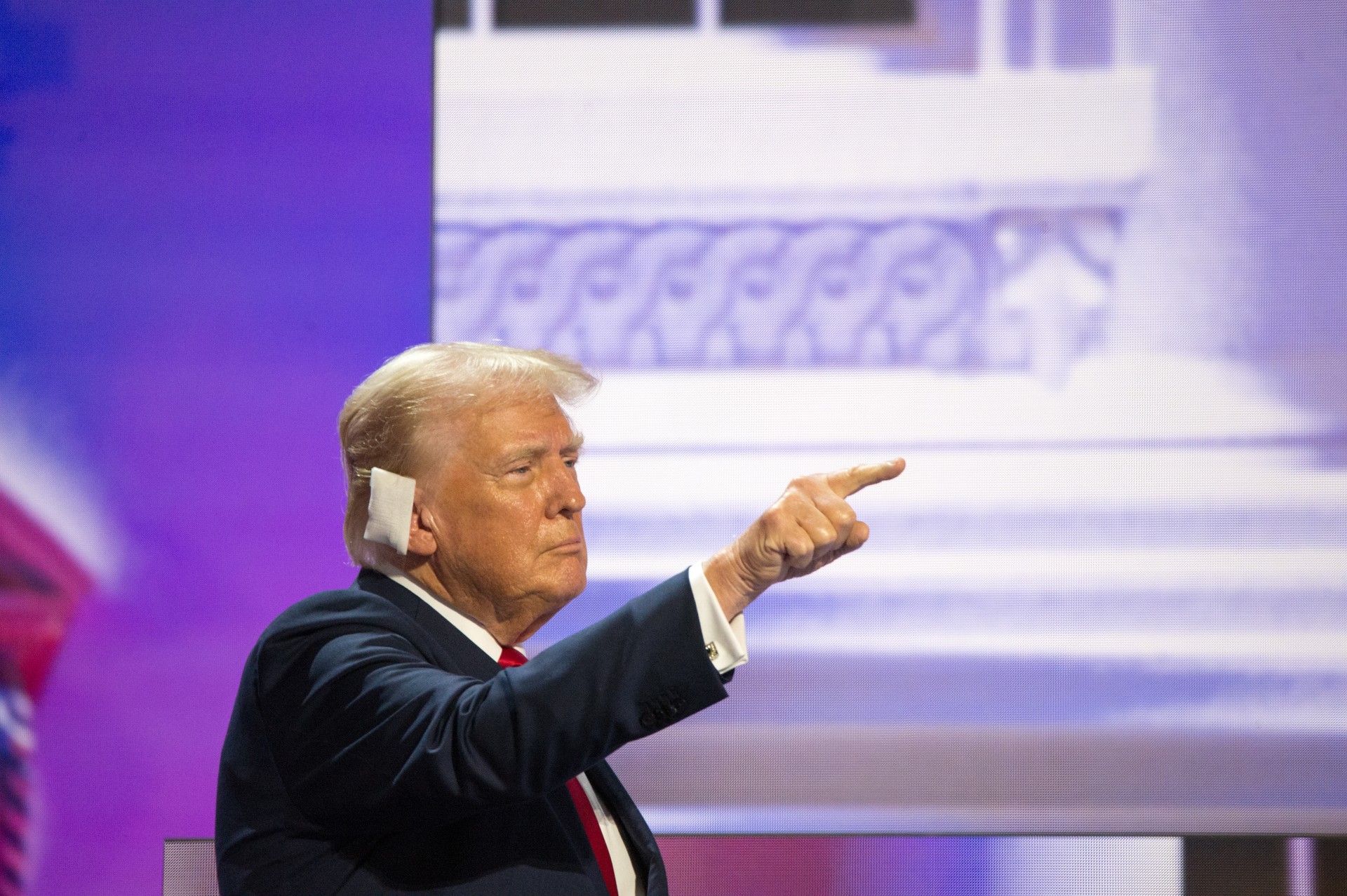

The price of bitcoin soared minutes after the shocking assassination attempt on the U.S. presidential candidate Trump, who presented himself as a champion for cryptocurrency, during a campaign rally in Butler, Pennsylvania on July 13. Bitcoin surged as traders increased their bets on Trump winning the November presidential election.

By 11:30 p.m. UTC on July 15, bitcoin's price had risen to $64,671, up 5.8% over the previous 24 hours and 14.2% for the week. The price has since peaked at around $65,000 but has slightly fallen to $63,664 at the time of writing.

“I think the rise (in the price of bitcoin) is directly correlated to the failed assassination of Trump,” Hong Kong-based Justin d’Anethan, head of business development for the Asia-Pacific region at crypto market maker Keyrock said. D’Anethan noted that Trump’s odds to regain the presidency “shot up” on prediction markets immediately after the incident.