Chinese electric vehicle (EV) sales in the European Union (EU) took a significant hit in July following the implementation of new tariffs aimed at protecting the region’s automakers.

The tariffs, which increase import duties to as high as 48%, have slowed the influx of low-cost Chinese-made EVs, particularly those from brands like BYD Co. and SAIC Motor Corp.'s MG.

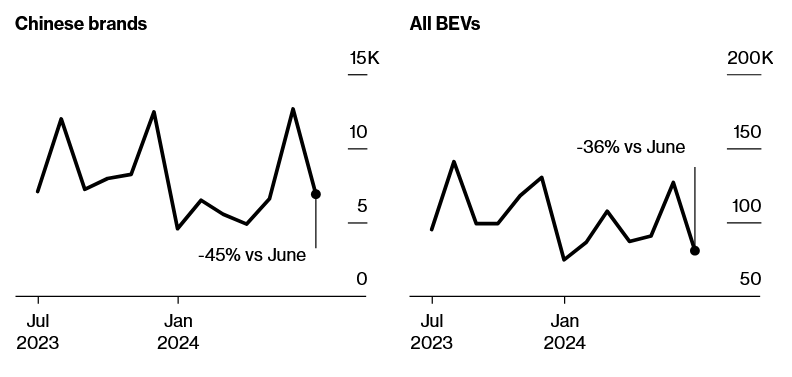

According to Dataforce, registrations of new Chinese-made EVs in the EU dropped by 45% in July compared to June. This decline was likely exacerbated by automakers rushing to get vehicles into the market before the tariffs took effect on July 5.

Matthias Schmidt, an independent auto analyst, noted a significant push by Chinese manufacturers to clear inventories in June, leading to what he described as an “inventory burn.”

Despite the overall drop, the decline in Chinese brands was not drastically out of line with the 36% decrease in EV sales across the 16 EU countries tracked by Dataforce. Western automakers like BMW, Stellantis, and Tesla, which also import Chinese-made EVs, experienced less pronounced drops due to more cautious inventory management.

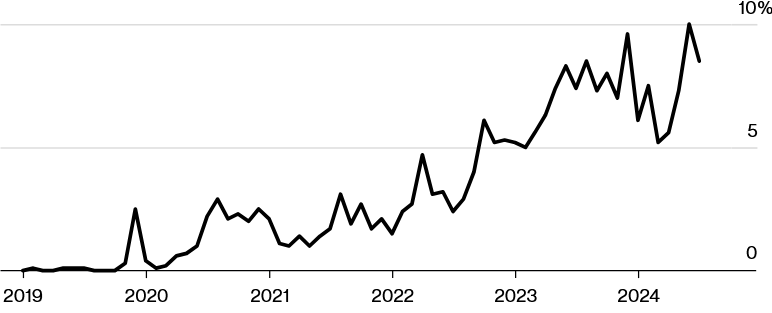

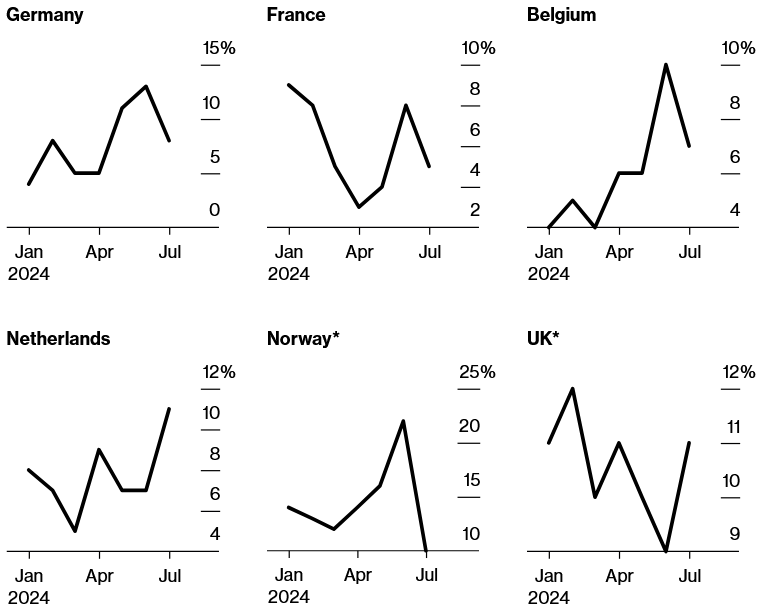

Despite the July setback, Chinese automakers have not signaled a retreat from the European market. Since 2019, brands like MG and BYD have steadily increased their presence, with their share of the EU's electric-car market rising to 8.5% in July, up from 7.4% a year earlier. While electric vehicles still represent a small portion of the European market, their dominance is expected to grow as combustion engines are phased out.

BYD, China’s top-selling car brand, saw its EV sales triple in the 16 tracked markets compared to the previous year. However, MG, a subsidiary of Chinese state-owned SAIC, reported a 20% drop in sales, while Polestar experienced a 42% decline. Despite these fluctuations, BYD’s expansion continues, underscored by its sponsorship of the Euro 2024 football tournament in Germany, which brought significant visibility to the brand.

The new tariffs were imposed following an EU investigation that concluded Beijing’s subsidies to its EV industry were causing economic harm to European automakers. These provisional tariffs are set to become permanent in November unless a deal is reached between Brussels and Beijing. For now, MG faces an additional 37.6% duty on top of the existing 10% rate, while Geely-owned Volvo and BYD will see their tariffs increase by 19.9% and 17.4%, respectively.

In response to the tariffs, Chinese automakers are accelerating plans to assemble EVs within Europe, and European manufacturers like Volkswagen AG and Stellantis NV are forming partnerships with Chinese companies to remain competitive. Despite the tariffs, BYD continues to push forward, expanding into new markets like Poland and has signaled that it can absorb the higher duties as it establishes a new plant in Hungary.

Matthias Schmidt emphasized that BYD’s strategy in Europe is one of perseverance, noting that despite logistical challenges like limited shipping capacity, the company remains committed to making inroads in the European market.