Türkiye reports 28 million active credit card users with 125 million cards

Credit cards. (Photo via Anadolu Agency)

Credit cards. (Photo via Anadolu Agency)

The Central Bank of the Republic of Türkiye (CBRT) has published a new report titled “Recent Trends in Card Spending Preferences,” revealing a notable increase in the use of credit and debit cards.

The surge is attributed to the widespread adoption of digital payment channels and the rising cost of carrying cash, which has been exacerbated by high inflation.

Card usage on the rise

The report highlights that Türkiye currently has approximately 28 million active credit card users, with a total of 125 million credit cards and 191 million debit cards in circulation.

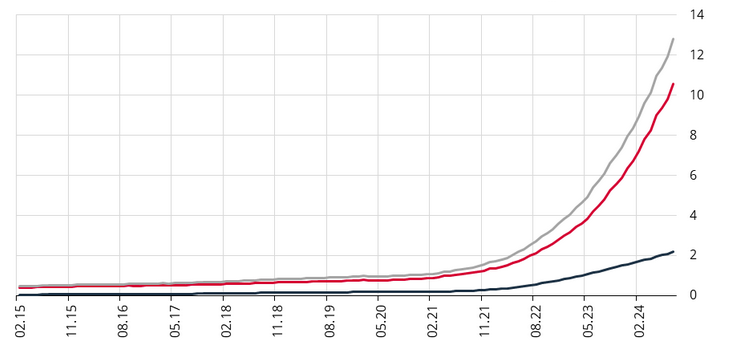

The total volume of card transactions has reached an impressive ₺12.8 trillion ($374.8 Billion).

The Central Bank notes that this growth is supported by the availability of cash advances and installment payment options, allowing consumers to borrow through credit cards.

Shift in consumer spending habits

One of the key findings of the report is the significant shift from cash-based transactions to card payments. The ease of use offered by card-based payment methods, coupled with the rapid rise of contactless payments during the pandemic, has contributed to this shift. Additionally, the cost and inconvenience of carrying cash have further reduced its use in daily transactions.

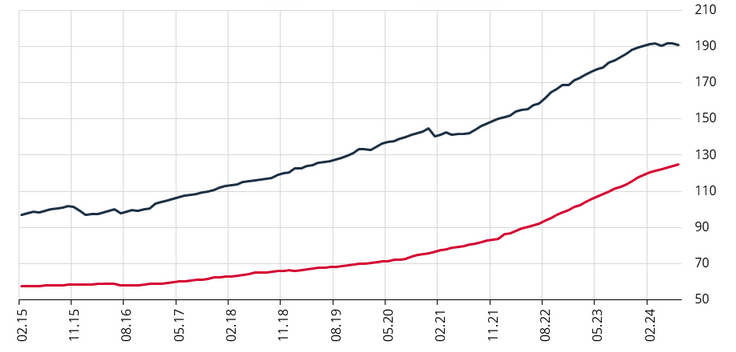

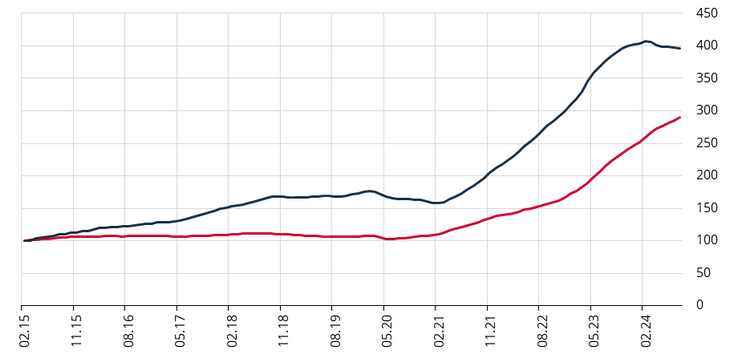

The report also indicates that between 2015 and 2023, spending via credit cards increased by 2 times in real terms, while debit card spending surged by nearly 3 times. Most of this growth occurred after 2021, as inflation began to accelerate, leading more people to rely on cards for their daily purchases.

Changing spending preferences

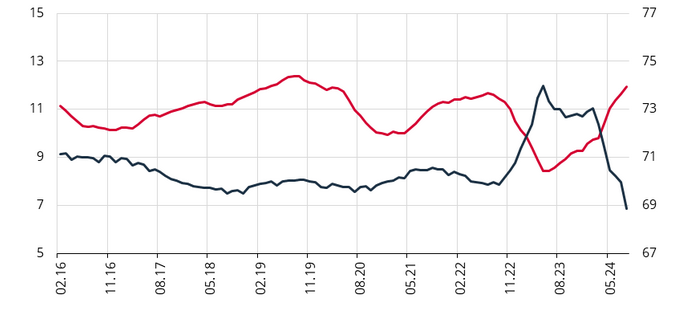

The report also highlights a shift in household consumption habits. “In recent years, the share of consumer spending using credit cards without installments or via debit cards has increased,” the Central Bank stated. Debit card usage for household spending rose from 6.8% to over 10%, while non-installment credit card transactions increased from 21% to 34%.

The preference for non-borrowing payment methods, such as debit cards, has outpaced credit card usage growth, suggesting that consumers are increasingly using cards for their convenience rather than for borrowing. The report emphasizes that three-quarters of credit card spending is non-installment, further indicating a preference for straightforward payments over credit.

Impact of inflation and technology

Inflation has also played a crucial role in driving this change. The report notes that from the end of 2021 through the third quarter of 2023, interest rates have generally remained below inflation, contributing to a rapid increase in card usage.

The Central Bank attributes this trend to technological advancements in payment systems and the increasing adoption of contactless payments. In 2015, there were only 2 million contactless transactions per month, but by 2024, this number has surpassed 1 billion monthly transactions.