Türkiye’s TLREF bonds yielding 50% attract foreign investors

Business and residential buildings are seen in Sisli district, in Istanbul, Türkiye, July 26, 2024. (Reuters Photo/Dilara Senkaya)

Business and residential buildings are seen in Sisli district, in Istanbul, Türkiye, July 26, 2024. (Reuters Photo/Dilara Senkaya)

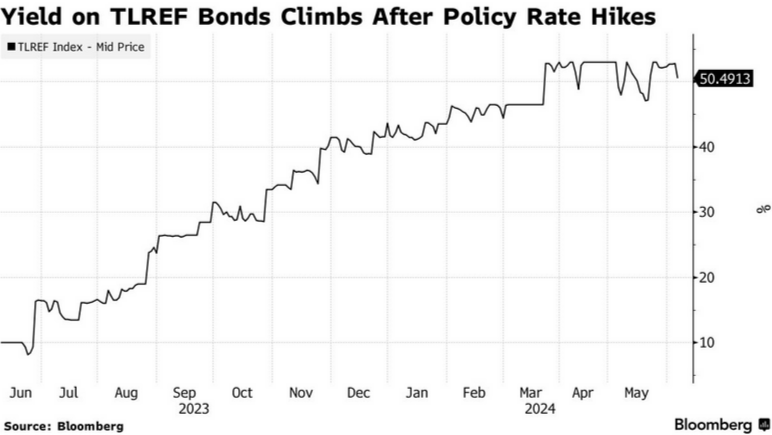

Türkiye’s soaring inflation is driving foreign investors toward a niche bond indexed to the Central Bank of Türkiye’s (CBRT) overnight reference rate, known as TLREF notes, offering yields around 50%.

The rising popularity of these bonds comes as investors shift focus from traditional fixed-coupon bonds amid expectations that Türkiye’s fight against inflation will continue well into next year.

TLREF bonds: Rising star for foreign investors to Türkiye

TLREF bonds, tied to the Turkish central bank’s overnight reference rate, have gained favor among foreign fund managers seeking high returns in emerging markets. Offering yields of about 50%, these bonds stand out compared to Türkiye’s traditional fixed-rate government bonds, which offer significantly lower yields – 42% for two-year notes and 28.7% for 10-year notes.

“I prefer TLREF bonds for the yield,” said Kieran Curtis to Bloomberg, director of investment at Abrdn in London. “It’s close to a 20-point drop in compound yield to own fixed-coupon bonds compared to this. That’s a lot of rate cuts.”

Türkiye’s high inflation keeps interest rates elevated

Türkiye’s central bank has maintained high interest rates to curb persistent inflation, which climbed as high as 86% in October 2022 and surged again to 75% in May this year. With no rate cuts expected in the near term, investors view TLREF bonds as an attractive option.

“The disinflation process will be long, and policymakers need to maintain high rates to reinforce credibility,” said Guillaume Tresca, global emerging-market strategist at Generali Investments in Paris, France.

Less appeal for fixed-rate bonds

As the inflation fight intensifies, traditional Turkish bonds have become less attractive. Tresca noted that “lira government bonds are not so cheap” given the challenges of disinflation.

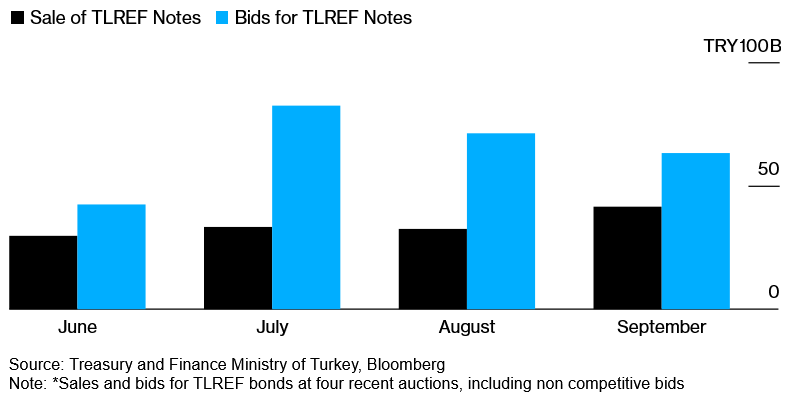

As a result, demand for long-term, fixed-rate lira bonds has dwindled. In recent auctions, four-year TLREF bonds drew bids totaling ₺63.2 ($1.9 billion), while demand for fixed-rate bonds due in 2033 reached only ₺13.4 billion.

Analysts suggest that Türkiye’s fixed-rate lira bonds may not regain their appeal until inflation stabilizes and the lira strengthens. AllianceBernstein Holding LP predicts that fixed-rate lira bonds won’t become attractive investments for at least six months.

Türkiye’s inflation battle continues

Türkiye’s central bank has remained hawkish, last raising rates in March by 500 basis points to curb inflation. Both Curtis and Tresca believe that a premature rate cut could undermine progress, making it necessary for interest rates to remain high.

“Turkish authorities have conducted the right policy, but it’s still a long journey,” Tresca noted.