Turkish central bank holds policy rate steady at 50%

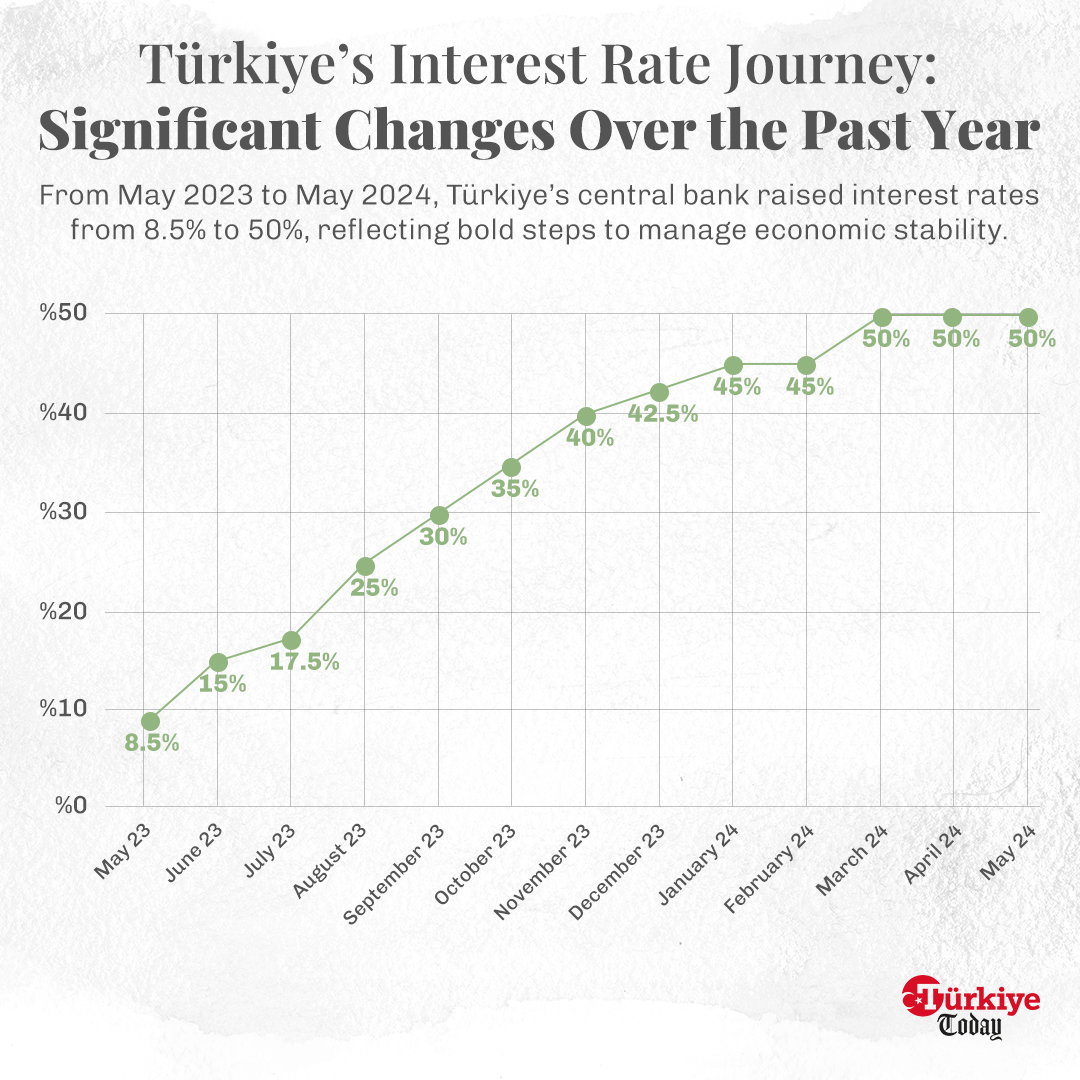

The Monetary Policy Committee (MPC) of the Turkish central bank, under the chairmanship of Yasar Fatih Karahan, has decided to maintain the policy rate, the one-week repo auction rate, at 50%.

“In April, the underlying trend of monthly inflation showed limited weakening. Recent indicators point to a slowdown in domestic demand compared to the first quarter,” the committee said.

Furthermore, the statement highlighted that the increase in the import of consumer goods in April has limited the improvement in the current account balance.

It was also noted that high levels of service inflation, inflation expectations, geopolitical risks and food prices continue to exert inflationary pressures.

The committee is closely monitoring the alignment of inflation expectations and pricing behaviors with projections.

“The effects of monetary tightening on loans and domestic demand are being closely observed. Considering the delayed effects of monetary tightening, the committee has decided to keep the policy rate unchanged while reiterating a cautious stance against upside risks to inflation,” read the statement.

A tight monetary policy stance will be maintained until a significant and permanent decline in the underlying trend of monthly inflation is achieved and inflation expectations converge to the forecast range, the statement further said, adding that if a significant and permanent deterioration in inflation is anticipated, the monetary policy stance will be tightened.

“The determined stance in monetary policy will reduce the underlying trend of monthly inflation and establish disinflation in the second half of the year through balancing domestic demand, real appreciation of the Turkish lira, and improvement in inflation expectations,” the statement highlighted.

‘Excess liquidity for Turkish lira financial assets will be sterilized’

The announcement also mentioned that the securities maintenance requirement has been terminated as part of the simplification of the macro-prudential framework and the enhancement of the market mechanism’s functionality.

“Considering recent credit growth and deposit developments, additional steps will be taken to protect macro-financial stability and support the monetary transmission mechanism,” it stated.

The statement indicated that excess liquidity resulting from the demand of domestic and foreign residents for Turkish lira financial assets would be sterilized with additional measures.

Central bank maintains tight monetary policy to achieve a 5% inflation target

The committee will set policy decisions by considering the delayed effects of monetary tightening and aim to create monetary and financial conditions that will reduce the underlying trend of inflation and bring inflation to the medium-term target of 5%.

“Indicators of inflation and its underlying trend will be closely monitored, and the committee will use all available tools decisively in line with the primary objective of price stability,” the statement emphasized.

It was also noted that the committee will make decisions within a predictable, data-driven, and transparent framework, and the summary of the Monetary Policy Committee meeting will be published within five business days.