Turkish banks face margin pressure amid high interest rates and delayed recovery

Skyscrapers are seen in the business and financial district of Levent, which comprises leading banks' and companies' headquarters, Istanbul, Türkiye, March 29, 2019. (Reuters Photo)

Skyscrapers are seen in the business and financial district of Levent, which comprises leading banks' and companies' headquarters, Istanbul, Türkiye, March 29, 2019. (Reuters Photo)

The outlook for Turkish banks remains constrained as high interest rates and restrictive lending policies weigh on net interest margins, according to a Bloomberg report.

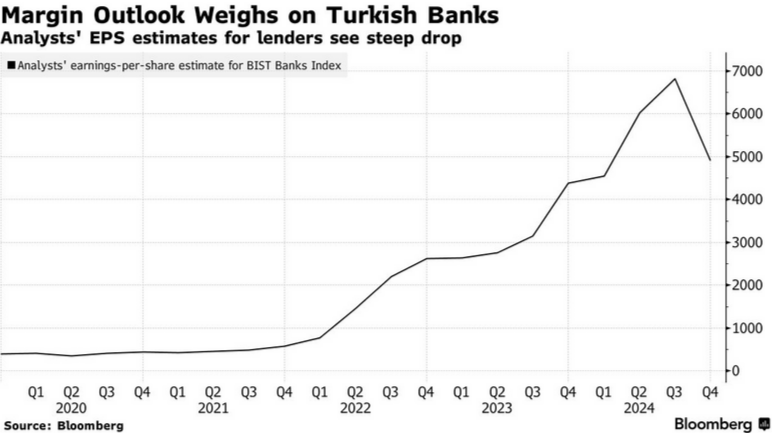

Analysts’ earnings estimates for Turkish lenders over the next 12 months have dropped by 28% since the end of September, according to Bloomberg data. This marks the first decline since March 2021.

High interest rates continue to squeeze margins

Following the reelection of President Recep Tayyip Erdogan in 2023, Türkiye’s central bank adopted a more orthodox monetary policy, raising the policy rate to 50%. This has strained banks’ net interest margins, with inflation still at 49% as of September 2024.

Analysts, including those from JPMorgan, have noted that recovery is unlikely until rate cuts begin, which some now expect to be delayed until next year.

Banking stocks decline amid pessimistic outlook

The banking sector has been underperforming, with the Borsa Istanbul Banks Index falling 18% in October, marking its worst monthly performance in over three years.

Analysts from Morgan Stanley have cautioned against expecting an immediate recovery while advising investors to wait for a more favorable entry point into Turkish bank stocks.

Mixed views on future recovery

Despite the challenges, not all analysts are pessimistic. HSBC and Bank of America see some longer-term potential for a rebound in Turkish banks, with Bank of America suggesting that high-quality earnings growth could materialize by 2025.

Akbank TAS is set to kick off the third-quarter earnings season on Oct. 24, having revised its year-end net interest margin forecast downward.