Gold prices soar as US inflation eases, Fed signals stability

As gold prices remain near their peak, recent signals from the U.S. economy suggesting a decline in inflationary pressures are met with optimism.

Although recent messages from Federal Reserve Chair Jerome Powell and several other Fed members suggest that an interest rate cut is unlikely in the short term, they also indicate that the door is closing on further rate hikes.

What are Fed members saying?

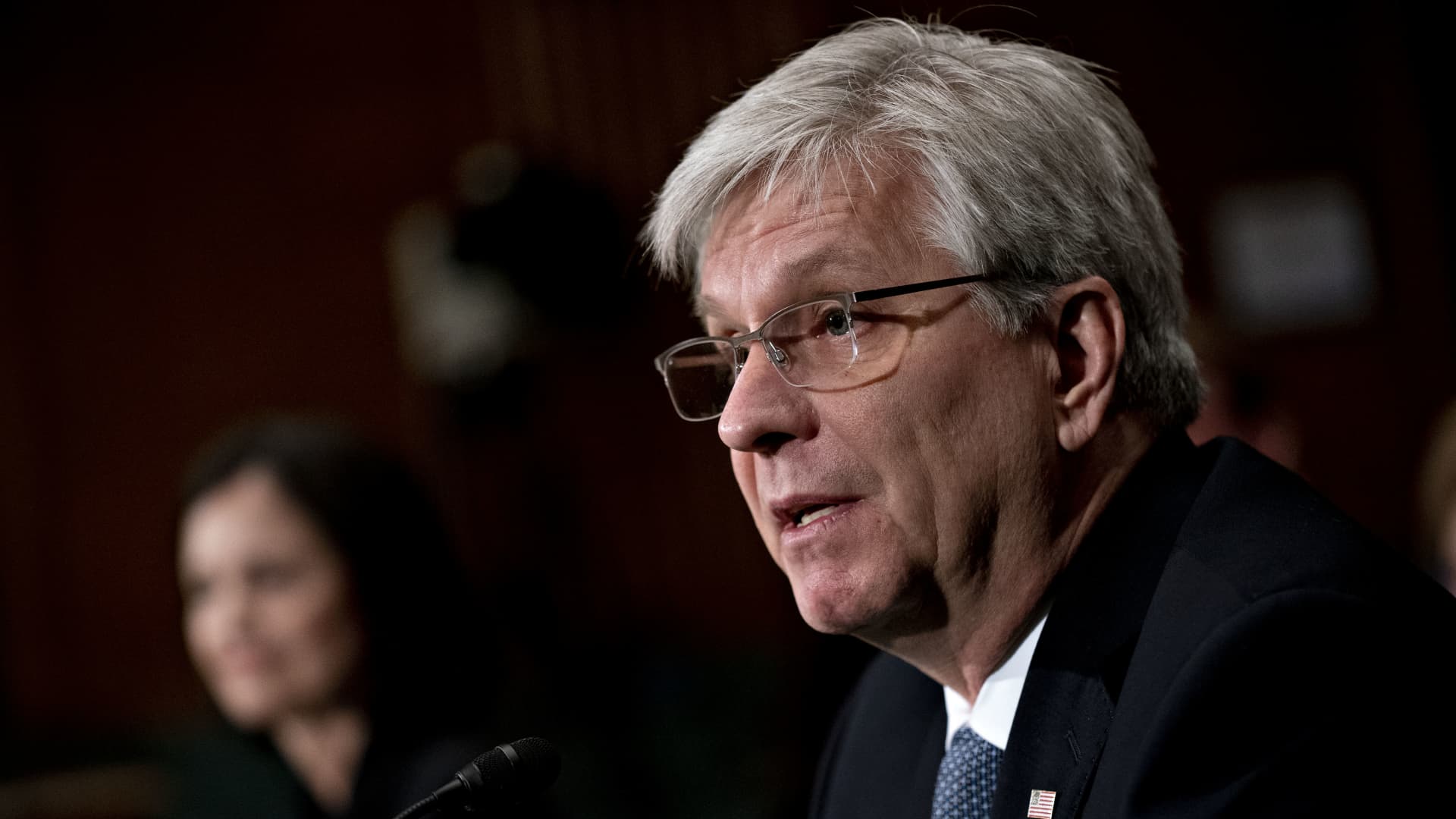

Most recently, Federal Reserve Board Member Christopher Waller noted that April’s Consumer Price Index (CPI) indicated that price increases are not continuing. He suggested that if positive data continues for a few more months, a rate cut could be possible.

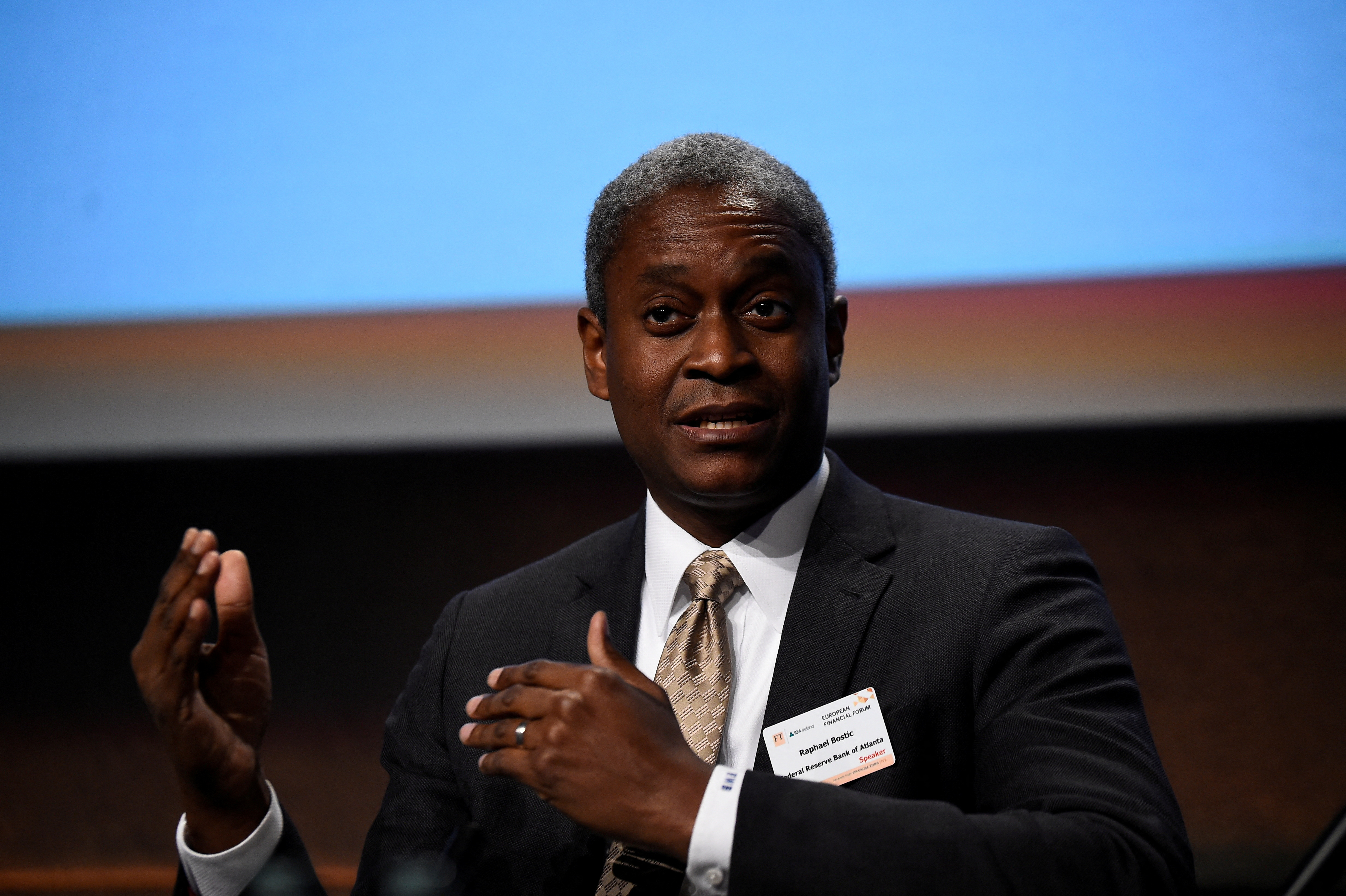

Atlanta Fed President Raphael Bostic also stated that while he is not in a hurry to cut rates, a reduction in the fourth quarter of the year might be expected alongside a decline in inflation.

Gold prices on May 22

In the free market, the price of a gram of gold started the day at ₺2500. At the Grand Bazaar, gram gold is trading in the ₺2480-2530 range. As of this morning, quarter gold is being sold at ₺4107, half gold at ₺8215, and full gold at ₺16,354 in jewelry stores.

In global markets, the price of an ounce of gold is hovering close to $2410.

Eyes on the Fed

The dollar index, which is significant for ounce gold, remains flat at $104.65, while U.S. 10-year Treasury yields are at 4.42%. Indicators for the dollar today are stable, but if tonight’s release of the latest Fed minutes provides clear signals toward a rate cut, market volatility could increase.

Key levels to watch in gold

Analysts note that due to the flat trajectory of the USD/TRY exchange rate, gram gold has found support from ounce prices in recent weeks.

“The price of an ounce of gold hit a peak of $2450 this week, but the crucial factor is its effort to stay above $2400 over the past three days. In a scenario where Fed expectations, geopolitical risks and central bank purchases persist, the likelihood of a decline in gold prices is diminishing. A weekly close above $2400 could signal new peaks for gold,” the analysts explained.