Gold prices rise, aligning with Goldman Sachs’ record forecast

Gold bars from the vault of a bank are seen in this illustration picture taken in Zurich November 20, 2014. (Reuters Photo)

Gold bars from the vault of a bank are seen in this illustration picture taken in Zurich November 20, 2014. (Reuters Photo)

Gold prices surged on Monday, recovering more than 1% after a 4% decline last week. According to Goldman Sachs, the precious metal is projected to reach $3,000 per ounce by 2025.

In the spot market, gold prices rose 1.4% to $2,598 per ounce at the start of the week. Meanwhile, the Turkish lira’s exchange rate, combined with gold’s international value, drove up gram gold prices 1.7% higher, surpassing ₺2,885.

Anticipated interest cut boosts gold prices

Goldman Sachs reaffirmed its bullish outlook for gold, citing robust central bank purchases and anticipated interest rate cuts by the U.S. Federal Reserve.

The bank also forecasts that gold will rank among the most traded commodities by 2025, with prices potentially benefiting from a Trump presidency.

In contrast, Deutsche Bank highlighted gold’s recent underperformance following Donald Trump’s election victory. During the two days after the Republican candidate win, the metal suffered its worst performance in at least 13 U.S. presidential elections.

By comparison, gold gained 2.9% in the two days following Joe Biden’s 2020 election victory, continuing an upward trend observed in the seven previous elections.

Gold prices stuck between FED and Trump

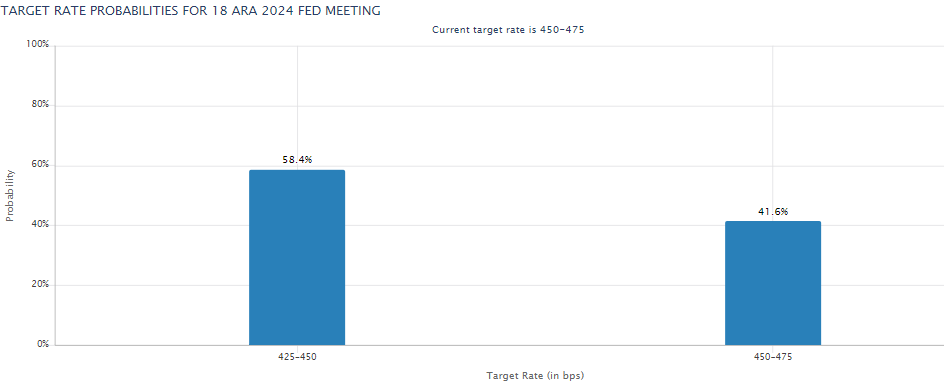

While former U.S. President Trump’s win has raised concerns about the inflationary impact of his policies, it has not substantially altered market expectations for Federal Reserve rate cuts. Nearly half of swap traders anticipate the Fed to lower rates as early as next month, even before Trump formally assumes office, according to the FedWatch tool.

In the immediate aftermath of Trump’s victory, gold prices dropped 1.4% over two days. The strengthening U.S. dollar—spurred by Trump’s win—and the overall resilience of the U.S. economy have tempered expectations for swift Fed rate cuts, adding downward pressure on gold prices.