Foreign economists’ perspectives on Turkish elections

Foreign economists attribute AK Party’s first election defeat since 2002 to high inflation

As Türkiye headed to the polls for the March 31 elections, the results surprised many. The Justice and Development Party (AK Party) experienced a historic setback by finishing second, while the Republican People’s Party (CHP) achieved significant success.

Foreign economists have evaluated Türkiye’s surprising election results, attributing the AK Party’s unprecedented defeat to high inflation and economic challenges.

High inflation deals blow to President Erdogan

In an analysis penned for the Financial Times, Adam Samson and Ayla Jean Yackley attributed the AK Party’s failure to achieve its desired outcome in the elections to various factors, including the economy. “Among the reasons behind these results is the economy,” they stated.

Moh Siong Sim, a strategist at the Bank of Singapore, remarked, “Markets will test President Erdogan’s determination to return to orthodox monetary policies after the local elections.”

Wolfango Piccoli, managing director at Teneo economic consultancy, commented that the main challenge ahead of Finance Minister Mehmet Simsek’s program is the adjustments to be made to pension payments.

Bloomberg, in its analysis of the local elections, noted that Erdogan suffered his first defeat since coming to power, attributing the election results to high inflation and increasing citizen debts. The analysis emphasized, “The Turkish people punished President Erdogan due to rising prices.”

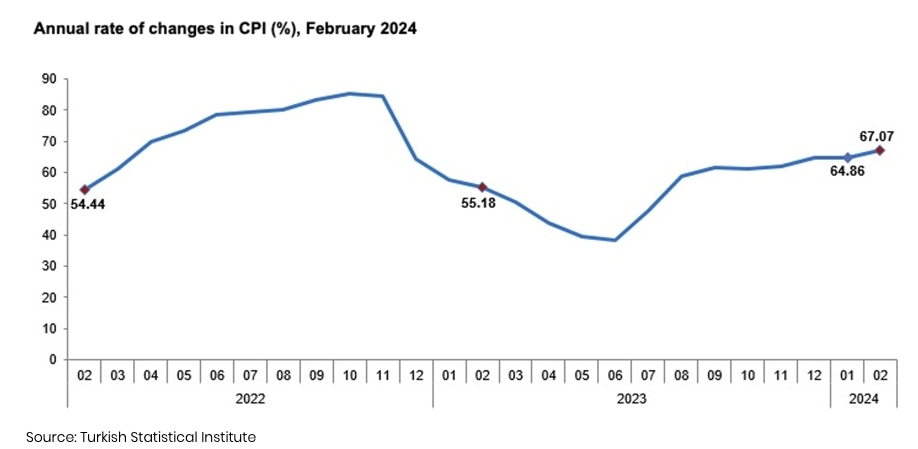

France 24, in its coverage of the local elections in Turkey, highlighted the economic issues as determinants of the results, stating, “Nearly 70% inflation and the depreciation of the Turkish lira against the dollar shaped the outcomes more than the success of the opposition.”

ActivTrades, in its analysis of the local elections, stated only time will reveal the impact of these elections on Türkiye’s economic direction. In the interim, active traders are urged to approach the market with caution, conducting thorough analyses of market dynamics and political developments to seize trading opportunities prudently.

It is emphasized that Turkish stock market attracts foreign investors amid election uncertainty. Despite macroeconomic and political challenges, Türkiye’s youthful population and export potential remain appealing

Polling amid economic hardship

Turkish stock market resilience amid lira decline

At the opening of the Turkish stock market on April 1, the index opened with a bullish gap, close to the upper Bollinger Band, but is now slightly down at around 9,197 points, with a Relative Strength Index (RSI) up and above its moving average at around 57.30.

Source: Newsroom