EU’s new emission targets divide automotive giants at Paris Motor Show

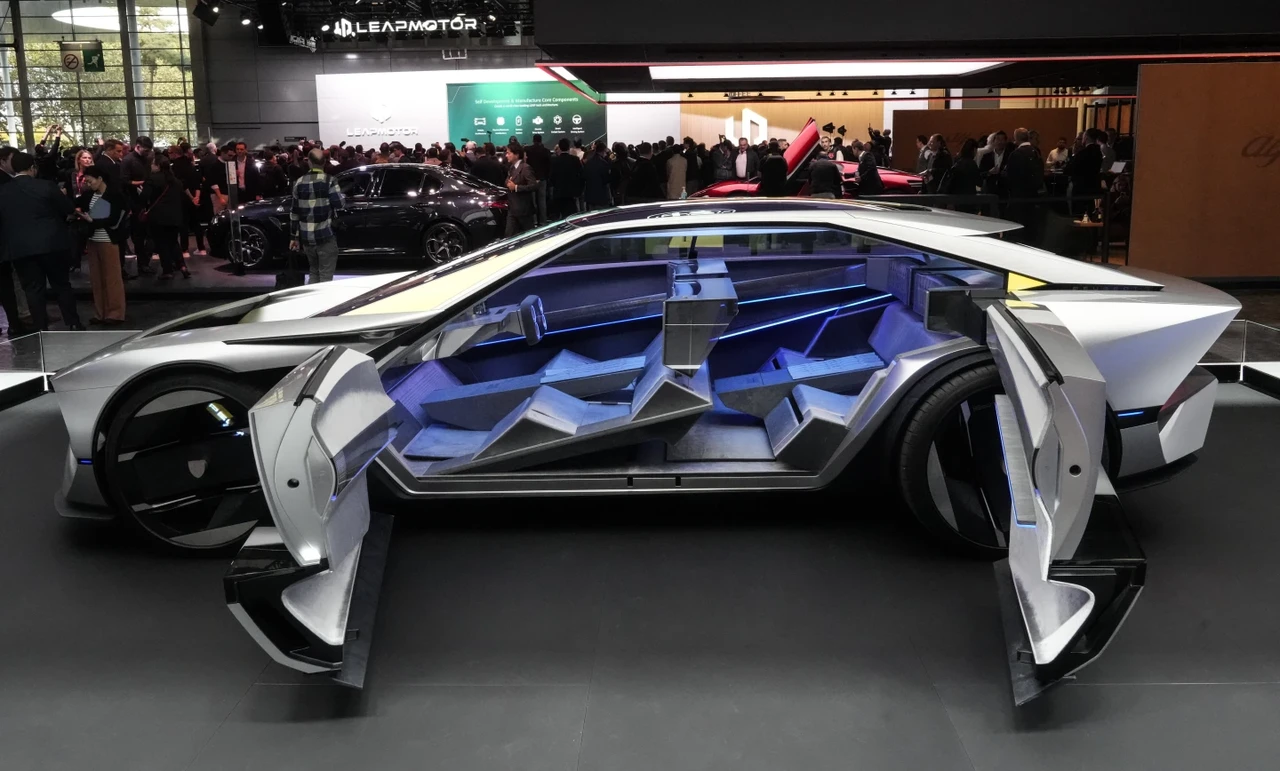

The Peugeot Hypersquare is presented at the Paris Motor Show, Paris, France, October 14, 2024. (AP Photo)

The Peugeot Hypersquare is presented at the Paris Motor Show, Paris, France, October 14, 2024. (AP Photo)

The European Union’s stringent carbon emission targets set to come into effect on January 1, 2025, have sparked intense debate among top automotive executives at the Paris Motor Show.

“If not postponed, we face up to €15 billion ($16.2 billion) in fines. Two million vehicles could halt production across Europe.” Stellantis CEO Carlos Tavares countered this stance, asserting, “Hesitation will leave us trailing behind the Chinese,” Renault Group CEO Luca De Meo warned.

Emission crisis could impact Türkiye’s automotive sector

Automotive giants worldwide are grappling with the EU’s strict emission regulations that demand an average of 95 grams of CO2 per kilometer for each vehicle from 2025 onward.

This legislation has significant implications for Türkiye, where over 80% of locally produced vehicles are exported to Europe.

Should automakers fail to increase the sales of zero-emission electric vehicles (EVs), they risk hefty fines and may even be forced to shut down production lines for petrol and diesel cars, threatening Türkiye’s exports.

Clashing opinions at Paris Motor Show

The 2025 regulation marks a crucial step toward the EU’s goal of selling only zero-emission vehicles by 2035. Although automotive brands have been preparing for this transition for years, sluggish EV sales and the influx of affordable Chinese electric cars have complicated matters.

Industry leaders at the Paris Motor Show were notably divided on whether the 2025 and 2035 targets should be postponed.

€15B in fines loom over industry

Renault Group CEO Luca De Meo, speaking recently on France Inter radio, emphasized the urgency of the 2025 targets. “Everyone talks about 2035, but we need to focus on 2025 because we are already facing challenges,” said De Meo, who also serves as the President of the European Automobile Manufacturers’ Association (ACEA).

He highlighted the need for flexibility, warning, “Without adjustments, the 2025 regulations could lead to the suspension of around two million vehicles’ production or result in fines as high as €15 billion ($16.2 billion.”

Chinese manufacturers lead in cost efficiency

Carlos Tavares, CEO of Stellantis, which includes brands like Peugeot, Citroen, Opel, and Fiat, argued that any delay in the 2025 transition would put the European automotive industry at a greater disadvantage.

“The harsh reality is that Chinese manufacturers produce EVs at one-third less cost than us,” said Tavares at the Paris summit.

“We must step up our game. Every moment of hesitation is lost time for development. Upholding the 2025 emission targets and the EU’s 2035 zero-emission mandate is an ethical responsibility.”

BMW’s call to rethink 2035 target

During the conference, BMW CEO Oliver Zipse proposed scrapping the 2035 ban on new fossil fuel-powered vehicles, citing Europe’s dependency on Chinese batteries.

Zipse argued that the regulation could lead to a significant contraction in the automotive industry, as electric vehicle sales are still below expectations and subsidies are becoming unsustainable.

95-gram limit: Automakers face steep penalties

The EU Commission’s regulation stipulates that all cars and light commercial vehicles produced in 2025 must emit no more than 95 grams of CO2 per kilometer on average, down from 116 grams in 2024.

Automakers failing to meet this target will incur a fine of €95 ($103) for every gram of CO2 exceeding the limit, multiplied by their total sales volume. Research indicates that to meet these targets, approximately 25% of vehicles sold next year must be fully electric, whereas the current share of EVs in Europe is below 15%, highlighting the scale of the issue.

Warning signs for Volkswagen, Ford

A recent report by the International Council on Clean Transportation (ICCT) identified Volkswagen and Ford as the furthest from achieving the 95-gram CO2 target among major automakers. The report suggests that, by 2025, the top ten manufacturers need to increase their EV sales by 12 percentage points to reach 28%.

While most automakers need to intensify their efforts to lower emissions, Volkswagen and Ford, in particular, must cut their emissions by around 21%, whereas Hyundai, Mercedes-Benz, and Toyota need reductions averaging over 12%. BMW, Kia, and Stellantis are closer to their targets, requiring CO2 cuts between 9% and 11%.

‘Türkiye faces serious challenges’

Cengiz Eroldu, Chairman of the Automotive Manufacturers Association (OSD) in Türkiye, voiced concerns about the potential impact on Türkiye’s automotive sector.

“Any downturn in the European market will inevitably lead to surplus vehicles being redirected to the Turkish market. We export the majority of our vehicles to Europe. A contraction in European demand would create excess capacity, putting pressure on the sales of vehicles produced by the Turkish automotive industry,” said Eroldu.

“Türkiye’s export competitiveness is eroding, and if proactive policies are not developed, we may see a decline similar to what happened in the textile sector, risking the sustainability of our factories.”

The automotive sector is at a critical juncture as it navigates the EU’s 2025 emission targets. With top industry leaders divided on how best to proceed, the future of both European and Turkish automotive production remains uncertain.

Accelerating the shift to electric vehicles while ensuring cost competitiveness will be key for automakers aiming to thrive in this evolving market.