Turkish market sets sight on CBRT’s expected interest cut in December

File photo shows Central Bank of the Republic of Türkiye (CBRT) sign at the entrance of its headquarters in Ankara, Türkiye. (AA Photo)

File photo shows Central Bank of the Republic of Türkiye (CBRT) sign at the entrance of its headquarters in Ankara, Türkiye. (AA Photo)

The Central Bank of the Republic of Türkiye (CBRT) is anticipated to begin policy interest rate cuts in December with a reduction of 150 basis points, market surveys revealed.

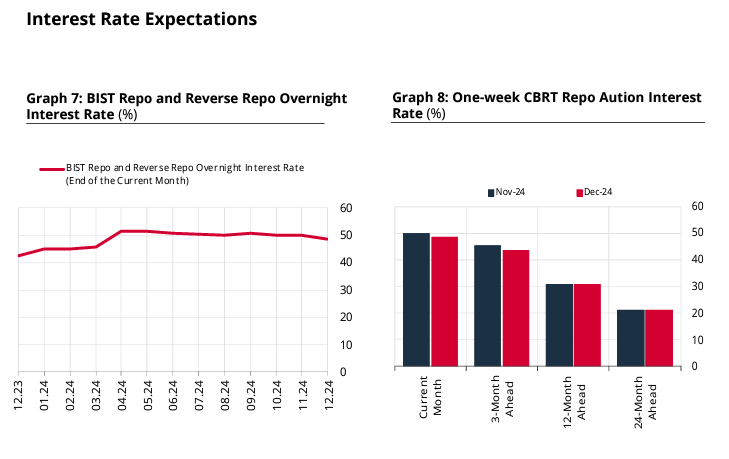

According to the Market Participants Survey by the CBRT, released on Friday, the policy rate expectation for the end of the current month stands at 48.51%, while the expectation for three months ahead has dropped to 43.50%.

CBRT’s December Market Participants Survey was conducted with 69 participants, including 17 representatives from the real sector and 52 from the financial industry. Key insights from the survey are as follows:

- The policy rate expectation for 12 months ahead rose slightly from 30.84% to 30.88%.

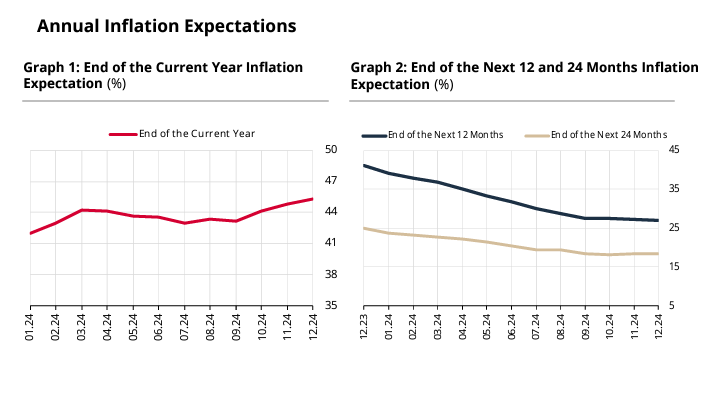

- The year-end Consumer Price Index (CPI) increase expectation has climbed to 45.28%.

- Accordingly, the December CPI increase expectation, which was 1.67% in the previous survey, has risen to 1.72% in this survey period. The current year-end CPI increase expectation also increased from 44.81% to 45.28%.

- While the CPI increase expectation for 12 months ahead decreased from 27.20% to 27.07%, the expectation for 24 months ahead rose from 18.33% to 18.47%.

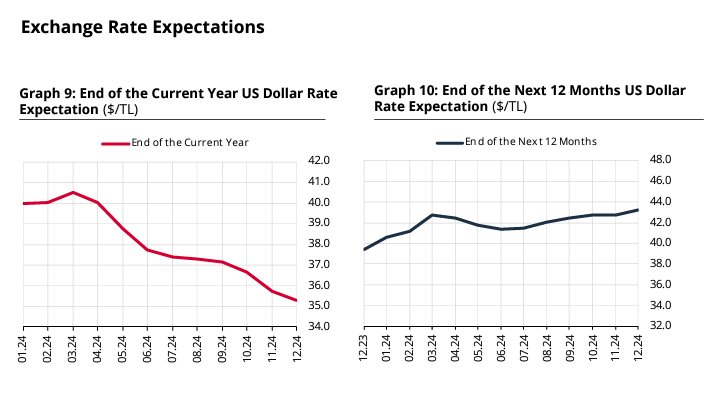

- Participants’ year-end USD/TRY exchange rate expectation fell from 35.7205 to 35.3011, whereas the expectation for 12 months ahead rose from 42.7475 to 43.2299.

- The year-end current account deficit expectation, which stood at $14.1 billion in the previous survey period, decreased to $9.8 billion. The current account deficit expectation for next year also fell to $18 billion.

- The gross domestic product (GDP) growth expectation for the current year declined from 3.1% to 3%, and for the next year, it dropped from 3.2% to 3.1%.

150-basis-point cut anticipated in December

Economists participating in the Anadolu Agency Finance expectation survey predict that the CBRT will lower the policy rate by 150 basis points to 48.50% in December.

The AA Finance expectation survey included insights from 14 economists as follows:

- Four economists anticipated the policy rate would remain unchanged while 10 forecasted a reduction.

- The average expectation among economists was a 150-basis-point cut, bringing the rate to 48.50%.

- Survey results indicate economists’ policy rate expectations range between 47.50% and 50.00%. The average policy rate expectation for the end of 2025 was recorded at 29.50%.

In the previous MPC meeting last month, the policy rate was held steady at 50% for an eighth consecutive month.

New steps to exit FX-protected deposits

Meanwhile, the CBRT has introduced new measures to encourage the transition from FX-protected deposits (KKM) to Turkish lira accounts.

A press release outlining the macroprudential framework was published on the CBRT’s website on Friday.

The statement emphasized the decision to support a reduction in KKM balances, designating that the overall target for the conversion and renewal of KKM accounts to Turkish lira has been lowered from 70% to 60%.

CBRT also decided to reduce the minimum interest rate for KKM accounts from 70% of the policy rate to 50%.

“Additionally, interest or compensation payments for required reserves for new and renewed KKM accounts have been removed,” CBRT stated.