Turkish ministry cracks down on tax evasion via IBAN transactions

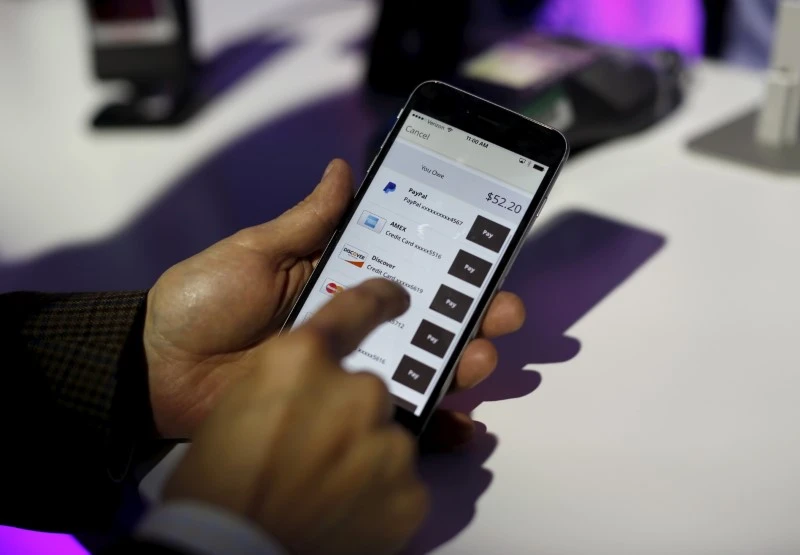

A payment is made on a mobile device during a PayPal demonstration at Terra Gallery in San Francisco, California May 21, 2015. (Reuters Photo)

A payment is made on a mobile device during a PayPal demonstration at Terra Gallery in San Francisco, California May 21, 2015. (Reuters Photo)

The Turkish Ministry of Treasury and Finance has uncovered widespread tax evasion through IBAN-based transactions, targeting 250 businesses across various sectors.

250 taxpayers face fines after evading taxes through IBAN-based transactions

Following an extensive investigation, the ministry found that TL 1.5 billion ($44.3 million) in income had been kept off the books, leading to TL 250 million ($7.3 million) in tax penalties for the companies involved.

Tax inspectors discovered that businesses were using IBAN transfers, often under the pretext of “POS machine not working” or other excuses, to collect payments without issuing invoices or receipts, bypassing taxation requirements.

As a result, a significant number of companies are under scrutiny as part of the government’s broader effort to clamp down on tax evasion.

$44.3M in undeclared income leads to $7.3M in tax penalties

Among the businesses targeted were several high-end restaurant chains with locations in Türkiye’s three largest cities, a jewelry and precious stones brand, a major auto parts retailer, wedding-organizing companies, social media influencers and real estate traders.

The investigation also identified links between IBAN transactions and transfers from cryptocurrency platforms, payment service providers and brokerage firms.

The ministry highlighted that certain transfers were also traced back to gambling shops and private accounts of family members, raising further concerns about illicit financial activities.

Officials intensify investigations into businesses using IBAN to bypass tax regulations

Finance Minister Mehmet Simsek issued a stern warning regarding the ongoing investigations.

He stated that those who claimed money entering their accounts belonged to others, and those using cash payments to evade taxes, would be thoroughly investigated.

Simsek emphasized that the ministry will continue to expand its efforts to root out tax evasion and hold businesses accountable.

“We are closely monitoring companies that collect payments through unregistered methods like IBAN without paying their taxes. Do not engage in unregistered activities by collecting untaxed income. We will pursue widespread and intensive inspections to promote tax fairness and reduce the informal economy,” Simsek said.

Türkiye aims to tackle tax evasion through robust enforcement, ensuring that businesses comply with tax regulations and avoid unfair competitive advantages.