Explained: Why Turkish central bank holds interest rates steady at 50%, again?

The entrance sign of the building housing the Central Bank of the Republic of Türkiye (CBRT), Ankara, Türkiye, Sept. 24, 2022. (Reuters Photo)

The entrance sign of the building housing the Central Bank of the Republic of Türkiye (CBRT), Ankara, Türkiye, Sept. 24, 2022. (Reuters Photo)

The Central Bank of the Republic of Türkiye (CBRT) has announced its anticipated interest rate decision for the month of August, maintaining the policy rate unchanged at 50% for the fifth consecutive month.

The Monetary Policy Committee has opted to keep the one-week repo auction rate, which serves as the policy rate, steady at 50%.

CBRT

Many economists and analysts widely expected the decision to hold the policy rate steady because of possible financial hurdles and economic risks expected in the face of a potential interest rate cut.

When central bank raised interest rate to 50%?

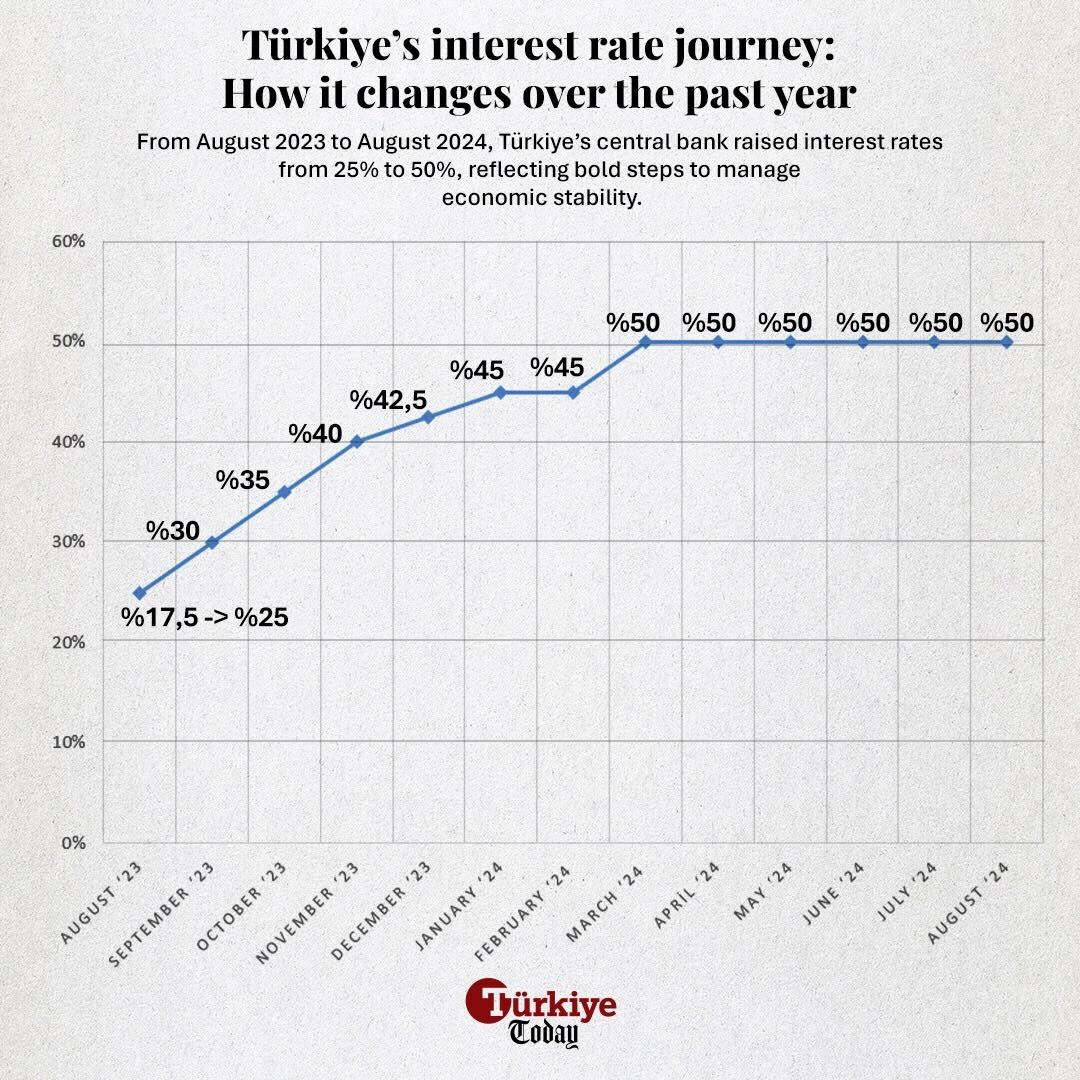

The CBRT raised its policy rate by 500 basis points to 50% in March, citing deterioration in the inflation outlook. It has kept the benchmark rate steady for five months since then while vowing to act if the inflation outlook worsens.

The bank has gradually lifted its policy rate by 4,150 basis points in a tightening cycle since June last year after a major shift in the economic policy following presidential and parliamentary elections.

When will central bank cut interest rate?

The central bank’s inflation forecast for the end of 2024 is 38%, with a more ambitious target of 14% by the end of 2025. Market analysts view the 2025 target as highly aggressive, stressing the critical importance of the rate-cut trajectory in achieving this goal.

With current market expectations for 2024 inflation are around 42%, the central bank is expected to start cutting the policy rate later this year or early in 2025, according to economists.

What would be ideal scenaorio for Türkiye’s interest rate?

In an exclusive interview with Türkiye Today, a Turkish chief economist of a private bank shared insights into central bank’s interest rate policy. According to the the chief economist, the possibility of the interest rate cutting in Türkiye reflects a broader economic challenge faced by governments worldwide and the timing is more important than the the interest rate cut.

- Timing is crucial: The chief economist suggested that the focus should not only be on the interest rate cut itself but also on when and how it will be implemented. If a rate cut were announced today, it would negate all efforts made so far, returning the economy to conditions from a year ago.

- Impact of high interest rates on growth: The chief economist said that while high-interest rates can suppress individual and consumer financing, they also create challenges for producers, especially concerning working capital needs. If access to loans becomes difficult, businesses may reduce production, leading to increased unemployment. Thus, a delicate balance must be struck between the interests of governments and central banks.

- Risk of recession: To avoid a recession, a gradual interest rate cut is expected, but the timing and magnitude of this cut are critical. If the central bank announces a rate cut in September or October, it is likely that the exchange rate will rise again due to existing vulnerabilities. However, delaying the cut until April or May 2025 could lead to a recession and widespread economic contraction, resulting in bankruptcies and systemic risks.

- Low current exchange rate: Currently, the budget deficit is substantial, and although the Central Bank’s reserves have reached approximately $152.2 billion, the chief economist said that the ongoing vulnerability of short-term foreign borrowing and the private sector means that preventing further currency depreciation is beneficial for Türkiye. Even though exporters may claim the current exchange rate is insufficient, allowing the lira to depreciate further in the absence of demand would not benefit the country.

Skipping rate cuts in August and September and possibly implementing a minor increase in October or November, if the Federal Reserve or European Central Bank also cuts rates, could lead to a more sustainable economic environment. By aligning with external developments and explaining the rationale for any interest rate policies, including inflation control, reserve increases, and improved external outlook, the central bank can better manage risks. A well-calibrated policy that maintains interest rates between 30-35% while controlling inflation around 25% by June 2025 could help sustain economic stability.

Turkish chief economist

Turkish central bank holds inflation forecast at 38%

- Inflation rate: Annual inflation fell to 61.78% in July, in what is expected to be a sustained drop with the impact of tight policy and a slowdown in domestic demand after peaking in May.

- CBRT’s forecast: On 8 August, during an inflation report presentation, CBRT Governor Fatih Karahan vowed to maintain a tight monetary policy stance while maintaining end-2024 and end-2025 inflation forecasts at 38% and 14%, respectively.

- What they’re saying: The report drew mixed reactions from economists and analysts, with some praising the CBRT’s approach and others expressing skepticism about the feasibility of the targets.