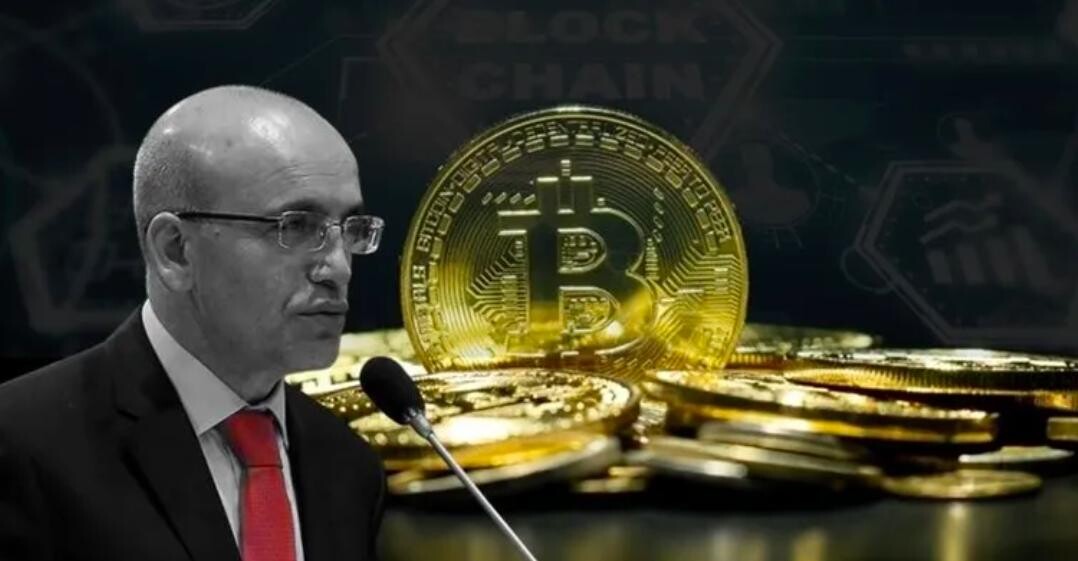

Finance Minister Simsek announces tax hikes on crypto and stock market gains

Finance Minister Mehmet Simsek has announced significant changes in Türkiye’s tax policies, including the elimination of numerous tax exemptions, reductions, incentives, and exceptions. Speaking at the AK Party’s consultation meeting in Kizilcahamam, Simsek detailed plans to increase taxes on income from fund revenues and to implement new taxes on profits from cryptocurrencies and stock market transactions.

Increased taxes on fund revenues

Simsek emphasized the government’s commitment to strict public savings measures while combating the informal economy and ensuring tax fairness. He stated that public investment allowances would be cut by 15%, prioritizing projects with more than 75% physical progress and suspending new projects in the public investment program.

Simsek outlined that the withholding tax on fund revenues, currently at 7.5%, would increase to 10% after July 31. A recent law also empowers the President to raise tax rates on some investment fund gains and foreign currency income up to 40%.

New steps for crypto and stock market taxation

The minister highlighted the need to tax earnings from cryptocurrencies and stock market transactions, aligning with global practices. “If there’s income, there should be tax,” Simsek said, stressing the importance of regulating these assets.

Attracting foreign investment

Simsek noted the interest of foreign investors in Türkiye, emphasizing that clear rules and legal guarantees are essential to attract more foreign capital. He projected a significant increase in fund inflows as confidence in Turkey’s ability to reduce inflation grows, citing a net foreign inflow of approximately $17 billion in the past 12 months.

Restructuring persistent loss-making companies

Simsek hinted at regulatory changes regarding long-term loss-making companies. He questioned the sustainability of companies consistently reporting losses, except for high-tech firms like Tesla.

“We have significant work on this, and we will share it with the public once we reach a certain point,” he added.

Inflation reduction efforts

Simsek also addressed inflation, asserting that it would decrease permanently. He dismissed any implicit or explicit exchange rate commitments, highlighting an unprecedented influx of capital into Türkiye.

“Foreigners’ share in bonds is approaching 10%. I believe there will be a substantial flow of funds as confidence in our inflation reduction efforts increases,” he concluded.